India’s deep tech ecosystem is surging, with over 3,600 startups leveraging cutting-edge technologies like AI, quantum computing, and biotechnology to address global challenges. As of 2025, these ventures, often rooted in intellectual property (IP) creation, have raised $10 billion over the past five years, cementing India as the sixth-largest deep tech hub globally. Yet, despite this momentum, a funding crunch, slow IP frameworks, and talent retention issues pose significant hurdles. This article explores whether India’s IP-driven deep tech startups are poised for global leadership or still grappling with systemic challenges, offering data-driven insights and trends shaping their trajectory.

Table of Contents

The Rise of Deep Tech in India

Deep tech startups, defined by innovations grounded in scientific or engineering breakthroughs, are transforming industries from healthcare to aerospace. In 2023, 480 new deep tech ventures emerged, nearly doubling the 2022 count, with AI dominating 74% of new startups and 86% of funding. The National Deep Tech Startup Policy (NDTSP), launched in draft form in 2023, aims to bolster this growth by enhancing IP frameworks and funding access. Initiatives like the Atal Innovation Mission and the ₹1 lakh crore Research, Development, and Innovation (RDI) Scheme are fueling R&D, while academic hubs like IIT Madras, which secured 300 patents in FY24, drive IP creation.

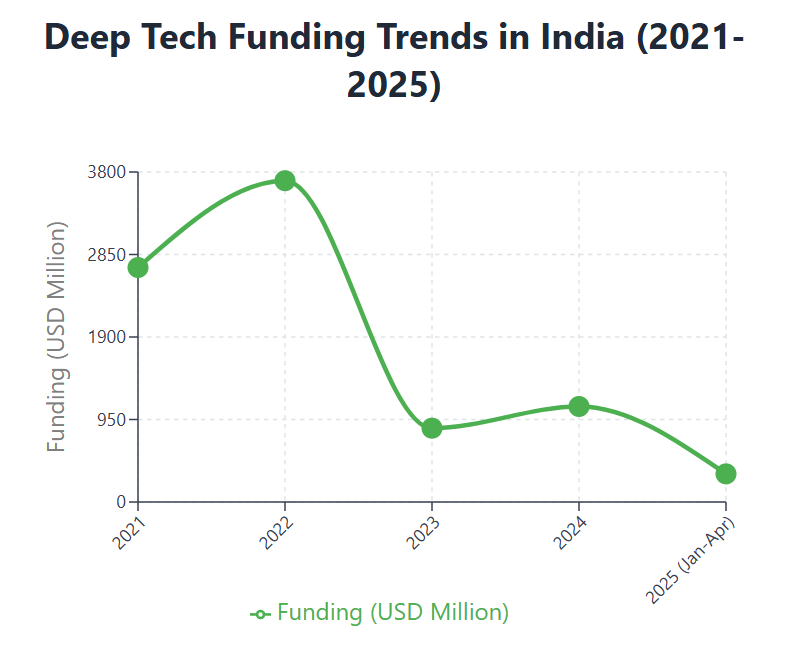

However, challenges persist. Funding plummeted 77% in 2023 to $850 million from $3.7 billion in 2022, with a 60% drop in investor participation. The average patent grant time in India (58 months) lags behind the US (23 months), hindering global competitiveness. Additionally, talent migration remains a concern, with Indian professionals contributing to global giants like OpenAI but lacking domestic ecosystems to retain them.

Key Trends and Insights

- AI Dominance: AI-driven startups, such as HealthPlix and UptimeAI, lead patent filings (41%) and funding, focusing on healthcare, enterprise tech, and cybersecurity. These ventures are shifting from SaaS to infrastructure-level innovations, signaling a maturing ecosystem.

- Academic-Industry Synergy: Over 50% of deep tech startups originate from academic environments, with IITs and IISc fostering ventures like Mindgrove’s Shakti processor. Faculty-led startups have surged 20-30% year-on-year, supported by sabbaticals and IP licensing.

- Funding Recovery: Early 2025 saw $324 million across 35 deals, doubling from 2024’s first four months, with standout investments like Netradyne’s $90 million for AI-driven fleet management. However, Series A and beyond remain challenging due to investor caution around long gestation periods.

- Global Acquisitions: Indian deep tech startups like Nayam Innovations and Bellatrix Aerospace are attracting global interest due to their IP portfolios and cost-effective talent, with acquisitions driven by firms seeking innovation at favorable valuations.

- Policy Support: The #100DesiDeepTechs initiative, launched in July 2025, aims to mentor 100 startups, shaping policy through dialogues with regulators and investors. The abolition of angel tax in 2024 has further boosted early-stage funding.

Data Table: Deep Tech Ecosystem Metrics (2023-2025)

| Metric | Value | Insight |

|---|---|---|

| Total Deep Tech Startups | 3,600+ | 480 new startups in 2023, 2x growth from 2022 |

| Funding (2023) | $850 million | 77% decline from $3.7B in 2022, investor caution persists |

| Funding (Jan-Apr 2025) | $324 million | Doubled from 2024, early-stage focus dominates |

| AI-Driven Startups (2023) | 74% of new ventures | 86% of funded startups, 41% of patent filings |

| Patent Grant Time | 58 months | Lags US (23 months), impacting global competitiveness |

| Academic-Linked Startups | >50% of total | IITs, IISc drive IP creation, 300 patents in FY24 (IIT Madras) |

Chart: Deep Tech Funding Trends (2021-2025)

Insights: Are We There Yet?

- Progress: India’s deep tech ecosystem is maturing, with a 40% CAGR projected through 2027, potentially contributing $350 billion to GDP by 2030. Startups like ideaForge (drones) and Agnikul Cosmos (3D-printed rocket engines) showcase global potential.

- Challenges: The funding gap at Series A and beyond, coupled with slow patent processes, limits scaling. Investors’ preference for low-risk seed-stage ventures stifles growth. Talent migration to global firms remains a hurdle, despite India’s vast STEM pool.

- Opportunities: Government initiatives like NDTSP and RDI Scheme, alongside academic collaborations, are bridging gaps. Cross-border partnerships with Japan and the EU in robotics and IoT are expanding market access.

- Global Competitiveness: While India excels in AI and space tech, catching up to leaders like the US requires faster IP processes and patient capital. Co-investment programs and tax breaks for IP-driven startups could accelerate progress.

Conclusion

India’s deep tech and IP-driven startups are on the cusp of global leadership, driven by AI innovation, academic synergies, and policy support. However, they are not “there yet.” Overcoming funding bottlenecks, streamlining IP frameworks, and retaining talent are critical to sustaining momentum. With strategic interventions, India’s deep tech ecosystem could transform from a promising hub to a global powerhouse, reshaping industries and addressing challenges like climate change and healthcare by 2030.

also read : Unleashing India’s Startup Potential: Key Research Topics to Explore the Dynamic Ecosystem

Last Updated on: Tuesday, July 22, 2025 4:52 pm by Siddhant Jain | Published by: Siddhant Jain on Tuesday, July 22, 2025 3:54 pm | News Categories: Tech, News, Startups, Trending