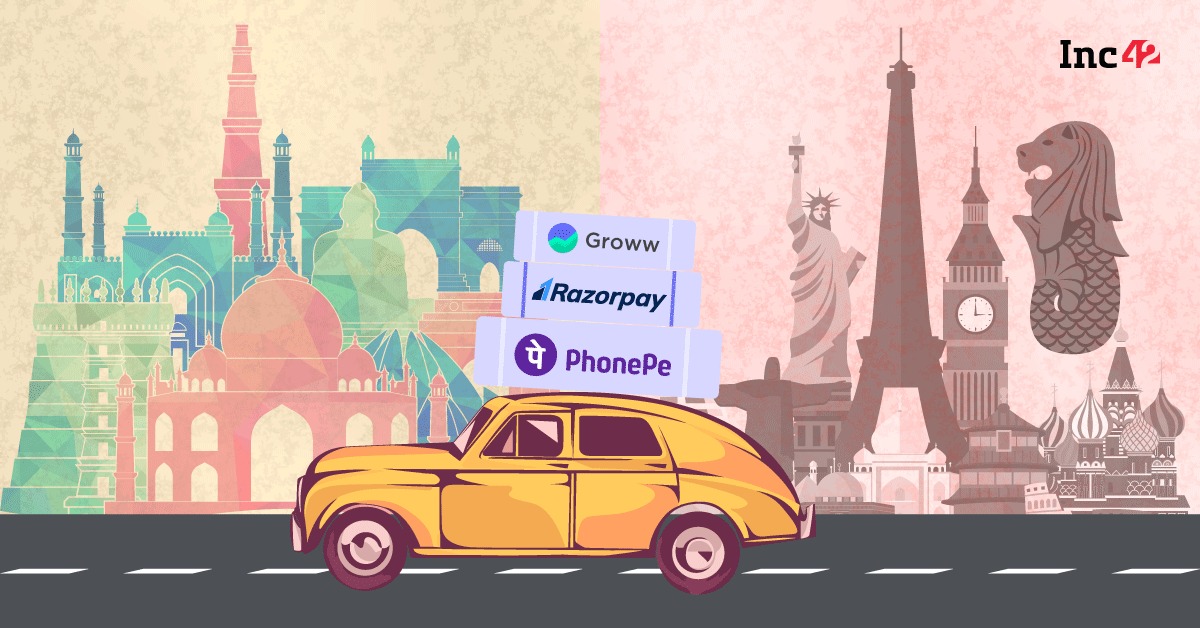

In a significant development within the Indian startup ecosystem, prominent unicorns Razorpay and Groww, both backed by renowned accelerator Y Combinator, have announced their plans to relocate their headquarters to India. This trend, known as “reverse flipping,” has gained traction as several Indian unicorns opt to establish their headquarters within the country.

With the emergence of reverse flipping, a growing number of Indian unicorns are making the strategic decision to move their headquarters from foreign locations back to their home country. Among the 108 Indian unicorns, approximately 20 have their headquarters situated outside India, presenting an opportunity for the country to attract and retain these high-value companies.

The complexity of India’s tax regulations emerges as a primary factor influencing the decision of these unicorns to opt for reverse flipping. The Indian tax regime has long been perceived as intricate and challenging, often posing obstacles for businesses operating both within and outside the country. By relocating their headquarters to India, these unicorns aim to navigate the complexities of the Indian tax system more effectively and optimize their operations within the country.

Razorpay, a leading fintech unicorn, and Groww, a fast-growing investment platform, are among the frontrunners in embracing reverse flipping. These companies recognize the strategic advantages of having their headquarters in India, such as proximity to the growing Indian market, access to a skilled workforce, and a favorable regulatory environment. By establishing a stronger presence within their home country, these unicorns seek to leverage the vast opportunities offered by India’s burgeoning startup ecosystem.

The decision to relocate their headquarters signifies a significant vote of confidence in India’s startup ecosystem and its potential for growth. It highlights the country’s emergence as a preferred destination for high-growth startups seeking to capitalize on the vast untapped market and talent pool available within India.

Furthermore, reverse flipping holds several advantages for these unicorns. It allows them to align their strategic operations and decision-making processes more closely with the local market dynamics and regulatory landscape. By establishing a stronger foothold in India, these companies can foster closer relationships with stakeholders, including investors, customers, and the government, which can positively impact their growth trajectory.

The Indian government has recognized the importance of reverse flipping and has introduced initiatives to facilitate the process for unicorns seeking to relocate their headquarters to India. These measures aim to create a conducive environment for startups and attract investments by streamlining regulatory procedures and enhancing ease of doing business.

Reverse flipping has the potential to further fuel India’s startup ecosystem, driving innovation, job creation, and economic growth. It reinforces the country’s position as a global hub for entrepreneurship and showcases the ability of Indian startups to compete on a global scale.

As more unicorns embrace reverse flipping, it is expected to have a cascading effect, inspiring other startups to consider relocating their headquarters to India. This shift can bolster India’s startup ecosystem, attracting capital inflows, fostering innovation, and positioning the country as a preferred destination for startups worldwide.

The trend of reverse flipping signifies a turning point in the Indian startup landscape, where Indian unicorns are reclaiming their roots and recognizing the immense potential of their home country. By embracing the challenges of India’s tax regime and leveraging the advantages offered by the Indian market, these unicorns are poised to make a substantial impact on India’s economic growth and solidify the country’s position as a global startup powerhouse.

Last Updated on: Thursday, May 11, 2023 7:41 am by Anu Priya | Published by: Anu Priya on Thursday, May 11, 2023 7:41 am | News Categories: Business, Economy, GENERAL, News, Startups, Tech

About Us: Business Byte covers a wide range of topics, including India news, business updates, startup insights, technology trends, sports, entertainment, lifestyle, automobiles, and more, led by Editor-in-Chief Ankur Srivastava. Stay connected on Website, Facebook, Instagram, LinkedIn, X (formerly Twitter), Google News, and Whatsapp Channel.

Disclaimer: At Business Byte, we are committed to providing accurate, reliable, and thoroughly verified information, sourced from trusted media outlets. For more details, please visit our About, Disclaimer, Terms & Conditions, and Privacy Policy. If you have any questions, feedback, or concerns, feel free to contact us through email.

Contact Us: businessbyteofficial@gmail.com || ankursri983@gmail.com