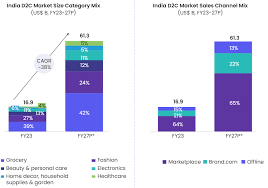

India’s direct-to-consumer (D2C) retail sector is experiencing a meteoric rise, transforming the way brands connect with customers. In 2024, the Indian D2C market was valued at $12.2 billion, with projections estimating a growth rate of 38% CAGR to reach $100 billion by 2030. By 2025, D2C brands are expected to account for 15% of India’s $300 billion e-commerce market, driven by digital adoption, evolving consumer preferences, and innovative business models. This article delves into the key trends fueling the D2C retail boom in India in 2025, highlighting the strategies, technologies, and market dynamics propelling this vibrant ecosystem.

The Rise of Digital-First Brands

The D2C model, which enables brands to sell directly to consumers through owned digital channels, has gained traction due to India’s massive digital population. With 1 billion internet users projected by 2025, including 700 million online shoppers, India offers a fertile ground for D2C brands. Unlike traditional retail, which relies on intermediaries like distributors and marketplaces, D2C brands leverage their own websites, apps, and social media to build direct relationships with customers.

Success stories like Mamaearth, Licious, and Boat exemplify this trend. Mamaearth, a personal care brand, scaled to a $1.2 billion valuation by focusing on clean-label products and digital marketing, while Boat captured the wearables market with affordable, trend-driven earbuds. In 2024, over 1,000 new D2C brands emerged, with 60% originating from tier-2 and tier-3 cities like Surat, Jaipur, and Coimbatore, reflecting the democratization of entrepreneurship. These brands are capitalizing on India’s 68% youth demographic (under 35) to drive demand for personalized, value-driven products.

Key Trends Shaping D2C Retail in 2025

1. Hyper-Personalization Through AI and Data Analytics

In 2025, D2C brands are leveraging artificial intelligence (AI) and data analytics to deliver hyper-personalized customer experiences. By analyzing consumer behavior, preferences, and purchase history, brands like The Man Company offer tailored product recommendations, boosting customer retention by 30%. AI-driven chatbots and virtual try-on features, as seen in Lenskart’s 3D try-on tool, enhance user engagement, particularly among Gen Z and millennials, who constitute 65% of online shoppers.

Data analytics also enables dynamic pricing and inventory management. For instance, D2C fashion brand Snitch uses predictive analytics to optimize stock levels, reducing wastage and improving margins. With 80% of D2C brands adopting AI tools in 2024, this trend is set to deepen in 2025, enabling brands to compete with e-commerce giants like Amazon and Flipkart.

2. Omnichannel Expansion: Blending Online and Offline

While D2C brands are digital natives, 2025 is witnessing a surge in omnichannel strategies. Recognizing the value of physical touchpoints, brands like Sugar Cosmetics and Wow Skin Science are opening experiential stores in tier-1 and tier-2 cities. These stores serve as brand experience centers, offering product trials, personalized consultations, and immersive storytelling. In 2024, D2C brands opened over 500 offline stores, with projections for 1,000 more in 2025.

The quick-commerce boom, led by platforms like Zepto and Blinkit, has also enabled D2C brands to deliver products in under 10 minutes in urban areas, blending online convenience with offline speed. For example, Licious partnered with quick-commerce platforms to deliver fresh meat and seafood, capturing 20% of its sales from tier-2 cities in 2024. This omnichannel approach enhances brand visibility and accessibility, driving customer loyalty.

3. Sustainability and Purpose-Driven Branding

Indian consumers in 2025 are increasingly eco-conscious, with 70% prioritizing sustainable products, according to a 2024 Nielsen report. D2C brands are responding by integrating sustainability into their core offerings. Brands like Bamboopeck and The Better Home offer eco-friendly products, from bamboo toothbrushes to biodegradable cleaning solutions, resonating with millennials and Gen Z. Mamaearth’s plant-based, toxin-free products and recyclable packaging have set a benchmark, with 40% of its sales driven by sustainability-focused marketing.

Purpose-driven branding extends beyond sustainability to social impact. For instance, D2C jewelry brand Giva supports women artisans in Rajasthan, while Blue Tribe promotes plant-based foods to combat climate change. These narratives create emotional connections, with 55% of consumers willing to pay a premium for brands aligned with their values, per a 2024 Deloitte survey.

4. Social Commerce and Influencer Marketing

Social media platforms like Instagram, YouTube, and WhatsApp are pivotal for D2C brands in 2025, with social commerce projected to reach $20 billion. Brands leverage short-form video content and influencer partnerships to drive sales. For example, Boat collaborates with micro-influencers (10,000–50,000 followers) to target niche audiences, achieving a 25% higher conversion rate than traditional ads. WhatsApp Business, used by 60% of D2C brands, facilitates direct customer engagement through personalized offers and chat-based commerce.

Live commerce is another emerging trend, with platforms like Instamojo hosting live-streamed product launches. In 2024, live commerce accounted for 10% of D2C sales, a figure expected to double in 2025 as brands tap into India’s 500 million social media users.

5. Funding and Financial Resilience

Despite a global funding slowdown, D2C startups raised $2.5 billion in 2024, with 20% of investments flowing to tier-2/3 cities. Micro-VC funds like 100X.VC and family offices like Sharrp Ventures are backing early-stage D2C brands, providing $50,000–$250,000 in pre-seed funding. Notable deals include Sugar Cosmetics’ $50 million Series D round and Mamaearth’s $80 million raise, signaling investor confidence in scalable D2C models.

To achieve financial resilience, D2C brands are focusing on profitability. In 2024, 30% of D2C startups reported positive EBITDA, up from 15% in 2022, driven by cost optimization and subscription models. Brands like The Sleep Company offer subscription-based mattress services, ensuring recurring revenue and reducing customer acquisition costs by 20%.

6. Regionalization and Vernacular Content

India’s linguistic diversity, with 22 official languages, is a key focus for D2C brands in 2025. Brands are creating vernacular content to connect with non-English-speaking consumers in tier-2/3 cities, where 90% of new internet users prefer regional languages. For instance, health food brand The Whole Truth offers Hindi and Tamil marketing campaigns, boosting its reach in North and South India. Regionalization extends to product offerings, with brands like Zouk designing handbags inspired by local crafts, resonating with cultural pride.

Challenges and Opportunities

The D2C boom is not without hurdles. High customer acquisition costs, averaging $10–$15 per customer, strain margins, particularly for bootstrapped brands. Competition from e-commerce giants and quick-commerce platforms, which charge 20–30% commissions, poses a threat. Additionally, logistics challenges in tier-2/3 cities, where last-mile delivery costs are 15% higher, require innovative solutions like partnerships with India Post or local couriers.

Yet, opportunities abound. The Open Network for Digital Commerce (ONDC), with 1,200 sellers and 29 million transactions in 2024, offers D2C brands a low-cost platform to reach new markets. Government initiatives like Digital India and Startup India provide tax benefits and incubation support, fostering growth. With India’s e-commerce penetration expected to rise from 8% to 15% by 2030, D2C brands have a vast untapped market.

The Road Ahead

In 2025, India’s D2C retail sector is poised for exponential growth, driven by technological innovation, consumer-centric strategies, and regional expansion. As brands embrace AI, omnichannel models, and sustainability, they are redefining retail by forging direct, meaningful connections with consumers. With 80% of D2C brands planning to expand internationally by 2027, targeting markets like Southeast Asia and the Middle East, India’s D2C ecosystem is not just a domestic success story but a global contender.

The boom of D2C retail in 2025 reflects India’s entrepreneurial spirit and digital prowess. From a Surat-based jewelry brand reaching global customers to a Coimbatore startup revolutionizing snacking, D2C businesses are proving that innovation knows no boundaries. As they continue to disrupt traditional retail, these brands are not just selling products—they’re building communities, driving economic growth, and shaping the future of commerce in India.

Sources: Inc42 D2C Report 2024, Tracxn, Nielsen, Deloitte, and posts on X.

Last Updated on: Monday, July 14, 2025 10:41 am by Puneeth kamalapuram | Published by: Puneeth kamalapuram on Monday, July 14, 2025 10:41 am | News Categories: Uncategorised