With strong support from both central and state initiatives, India has emerged as the world’s third-largest startup ecosystem, with over 1.57 lakh startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) as of June 2024. While central schemes like the Startup India Seed Fund Scheme (SISFS) and the Fund of Funds (FoF) have catalyzed growth, state policies play a crucial role in shaping on-ground outcomes. This article provides an original state-wise comparison of startup policies across India, highlighting their strengths, gaps, and contributions to the nation’s entrepreneurial landscape as of July 2025.

Table of Contents

Karnataka: The Silicon Valley Model

Karnataka, home to Bengaluru—the startup capital—leads with its Karnataka Startup Policy 2022-27. Aimed at supporting 25,000 startups by 2027, it offers seed funding up to Rs 50 lakh through the Elevate program, targeting women and SC/ST founders, and reimburses patent costs up to Rs 20 lakh. The state’s 98 DPIIT-recognized incubators and tax incentives for investors have birthed unicorns like Swiggy and Byju’s. However, high real estate costs and infrastructure strain remain hurdles, with the Global Capability Centers (GCCs) share projected to drop to 30% by 2025 from 35% in 2020.

Telangana: Hyderabad’s Niche Focus

Telangana’s Telangana Startup Policy 2022-27 positions Hyderabad as a cost-effective hub, supporting over 1,500 startups with incentives like a 25% investment subsidy and Rs 1 crore seed funding via T-Hub. It excels in spacetech and biotech, with firms like Skyroot Aerospace benefiting. The state’s 355 GCCs and focus on enterprise tech are strengths, but limited VC activity and fewer startups compared to Karnataka (1,500 vs. 3,200+) highlight a need for broader investor engagement.

Uttar Pradesh: Scaling Ambitions

Uttar Pradesh’s UP Startup Policy 2020-2023, recently extended, targets 40,000 startups by 2027, offering Rs 50 lakh seed funding and a sustenance allowance of Rs 25,000 monthly for two years. With 4,500+ startups, including Paytm, the state leverages its large market and 100-acre innovation parks. Yet, bureaucratic delays and uneven infrastructure across districts dilute its impact, necessitating streamlined processes.

Maharashtra: Mumbai’s Financial Edge

Maharashtra’s Startup Policy 2021-2026 focuses on Mumbai and Pune, providing Rs 10 crore venture capital support and tax exemptions for five years. Hosting 17,000+ startups and 26 unicorns like Zomato, it benefits from financial networks. However, high operational costs and competition for talent pose challenges, with Pune’s rise in SaaS offering a counterbalance to Mumbai’s expense.

Tamil Nadu: Chennai’s Inclusive Growth

Tamil Nadu’s Startup Policy 2018-2023, extended to 2027, aims for 15,000 startups, offering Rs 1 crore seed funding and a 25% patent cost subsidy. Chennai’s 2,500+ startups, including Freshworks, thrive on its manufacturing base and low costs. The state’s focus on Tier-2 cities like Coimbatore is promising, but limited early-stage capital and incubator capacity hinder scalability.

Gujarat: Ahmedabad’s Industrial Boost

Gujarat’s Startup Policy 2022-27 targets 50,000 startups, providing Rs 5 crore equity funding and a 100% electricity bill subsidy for three years. With 3,000+ startups and CarDekho’s success, it leverages its industrial ecosystem. However, a bias toward manufacturing over tech and fewer incubators (50 vs. Karnataka’s 98) limit its tech startup growth.

Emerging States: The Tier-2 Surge

States like Rajasthan, Odisha, and Assam are crafting policies to tap Tier-2 potential. Rajasthan’s Startup Policy 2022-27 offers Rs 25 lakh grants and tax holidays, supporting 1,200 startups. Odisha’s 2023-28 policy provides Rs 1 crore seed funding, aiding 800 startups in Bhubaneswar. Assam’s 2022-27 plan focuses on agri-tech with Rs 50 lakh support. These states show promise but lack the mature ecosystems of metros, with fewer than 100 incubators combined.

Comparative Insights

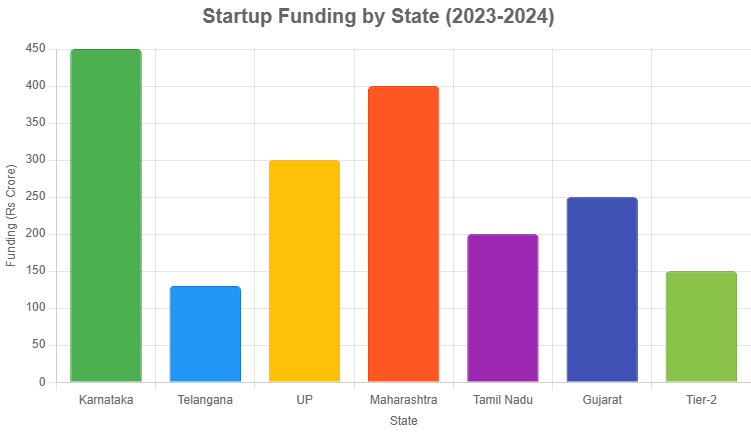

The States’ Startup Ranking Framework, launched in 2018 by DPIIT, evaluates these policies annually. Karnataka and Telangana consistently rank high due to robust incubators and funding, while Uttar Pradesh and Maharashtra gain from market size. Tamil Nadu and Gujarat excel in inclusivity and industrial integration, respectively, but Tier-2 states lag in infrastructure and investor networks.

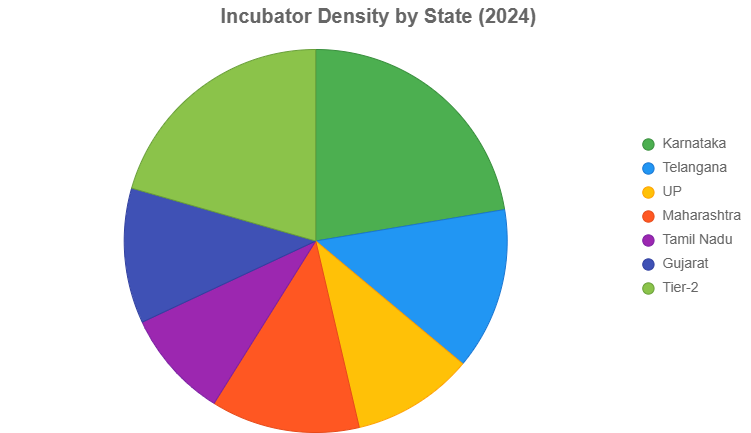

Funding models vary: Karnataka and Telangana offer direct grants, Uttar Pradesh and Maharashtra blend grants with allowances, and Gujarat emphasizes equity. Patent support is strongest in Karnataka (Rs 20 lakh) and Tamil Nadu (25% subsidy), while Maharashtra and Uttar Pradesh focus on tax breaks. Incubator density is highest in Karnataka (98), followed by Telangana (60), reflecting their tech focus.

Economic and Social Impact

These policies have generated over 17.28 lakh jobs by December 2024, with Karnataka and Maharashtra leading due to unicorn density (26 and 17, respectively). Tamil Nadu’s focus on manufacturing and Gujarat’s industrial base boost MSME growth, while Tier-2 states like Rajasthan enhance rural employment. Women-led startups benefit most in Karnataka (Elevate) and Tamil Nadu, though national VC funding for women remains at 9.3% (2023), indicating a persistent gap.

| State | Policy Years | Target Startups | Funding Support (Rs) | Key Incentives | Incubators | Unicorns | Challenges |

|---|---|---|---|---|---|---|---|

| Karnataka | 2022-27 | 25,000 | 50L (seed), 20L (patent) | Tax breaks, Elevate | 98 | 26 | High costs, infrastructure |

| Telangana | 2022-27 | 1,500+ | 1Cr (seed), 25% subsidy | T-Hub, GCC support | 60 | 5 | Limited VC activity |

| Uttar Pradesh | 2020-27 | 40,000 | 50L (seed), 25K/month | Innovation parks | 45 | 6 | Bureaucratic delays |

| Maharashtra | 2021-26 | 17,000+ | 10Cr (VC), 5-yr tax | Financial networks | 55 | 26 | High costs, talent race |

| Tamil Nadu | 2018-27 | 15,000 | 1Cr (seed), 25% patent | Tier-2 focus | 40 | 7 | Capital access |

| Gujarat | 2022-27 | 50,000 | 5Cr (equity), 100% power | Industrial ecosystem | 50 | 5 | Tech incubator scarcity |

| Tier-2 (Avg) | 2022-27 | 1,200-800 | 25L-1Cr (grants) | Tax holidays | <100 | 2-3 | Underdeveloped ecosystem |

Comparative Analysis

Karnataka and Telangana lead in incubators and funding, while Maharashtra and UP dominate job creation due to market size. Tamil Nadu and Gujarat shine in inclusivity and industry integration, but Tier-2 states lag in maturity. Funding ranges from grants (Karnataka, Rs 50 lakh) to equity (Gujarat, Rs 5 crore), with patent support strongest in Karnataka and Tamil Nadu.

Economic and Social Impact

Policies have driven 17.28 lakh jobs by December 2024, with Karnataka and Maharashtra leading due to unicorns (26 and 17). Tamil Nadu boosts MSMEs, and Gujarat supports rural industries. Women-led startups gain in Karnataka and Tamil Nadu, though VC funding for women remains at 9.3% (2023).

Challenges and Gaps

Bureaucratic delays hit UP and Assam hardest, with 60+ day approvals. Funding caps suit tech but not biotech, and Tier-2 states lack specialized incubators. Investor bias toward metros persists, with data gaps complicating assessments

also read: 5 Impactful Ways Government-Backed Funds Are Shaping Early-Stage Startups in India

Last Updated on: Monday, July 21, 2025 4:58 pm by Swayam Sharma | Published by: Swayam Sharma on Monday, July 21, 2025 4:58 pm | News Categories: News, Trending