India’s startup ecosystem, backed by government funds, has emerged as a global standout with over 1.57 lakh recognized startups by December 2024. A key driver behind this growth is the strategic deployment of funds to support early-stage ventures. With initiatives like the Startup India Seed Fund Scheme (SISFS) and a new Rs 10,000 crore Fund of Funds (FoF) for 2025, the government is fueling innovation. This article explores how these funds impact startups.

Table of Contents

A Lifeline for Nascent Ideas

Early-stage startups often struggle to secure capital for ideation and prototypes. Traditional VCs prefer later-stage firms, leaving a funding gap. SISFS, launched in 2021 with Rs 945 crore, addresses this by offering up to Rs 50 lakh per startup through 217 incubators. By 2023, it supported over 3,600 ventures, including a Bengaluru AI startup that cut crop losses by 15%. The new Rs 10,000 crore FoF, managed by SIDBI, will channel funds via AIFs, building on Rs 20,572.14 crore infused by October 2024.

Sparking Innovation and Jobs

These funds prioritize sectors like AI, IoT, and clean energy, aligning with national goals. NIDHI’s 170+ TBIs, funded with Rs 220 lakh each, have driven innovations like a Hyderabad ventilator during COVID-19. Job creation is significant, with startups generating 17.28 lakh jobs by December 2024. CGTMSE’s collateral-free loans up to Rs 1 crore enabled a Chennai edtech firm to hire 150 teachers, boosting digital education in Tier-2 cities. Additionally, sector-specific accelerators are helping scale innovations in agritech and healthtech. These targeted efforts are bridging the gap between grassroots ideas and global impact.

Promoting Inclusivity

Government schemes target underrepresented groups. Karnataka’s Elevate program offers Rs 50 lakh grants to women and SC/ST founders, while the Rs 2,000 crore India Aspiration Fund supports Tier-2 and Tier-3 startups. A Jaipur agritech startup, led by a woman, used IAF funds to empower 500+ farmers. This inclusivity reduces regional disparities, aligning with Atmanirbhar Bharat’s vision. These initiatives also encourage entrepreneurship in non-traditional sectors such as waste management and handicrafts. As a result, a more diverse and resilient startup ecosystem is gradually taking shape.

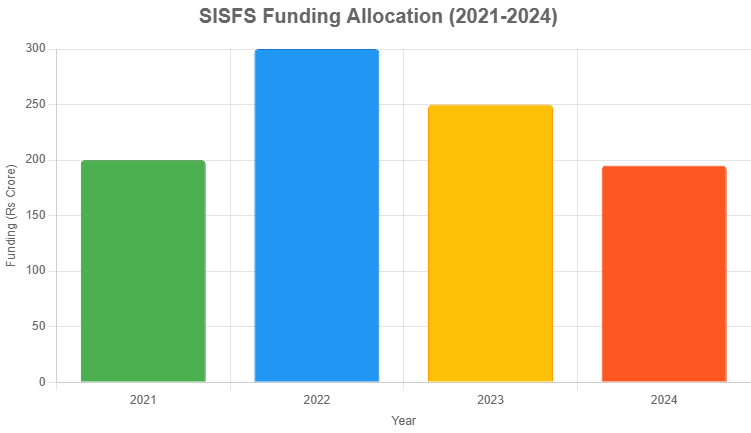

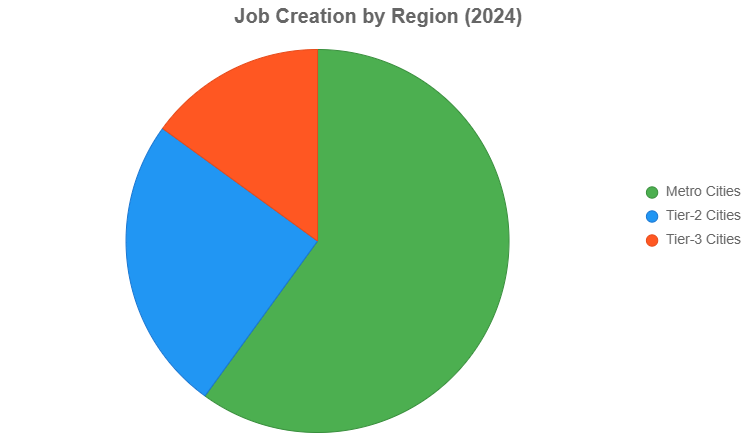

Visualizing the Impact

Funding Allocation (2021-2024)

Job Creation by Region

Challenges to Overcome

Bureaucratic delays plague the process, with startups citing slow disbursements. The Rs 50 lakh cap under SISFS suits tech but falls short for biotech or hardware, where costs exceed Rs 5 crore. FoF’s reliance on AIFs introduces profit-driven biases, with only 9.3% of VC funding going to women-led startups in 2023. Tier-2 incubators lack facilities, limiting deep-tech support, while CGTMSE’s enhanced Rs 20 crore cover benefits MSMEs more than startups.

Scaling the Future

Simplifying applications with digital tools can speed up funding. Raising caps for capital-intensive sectors and mandating 20% AIF allocation to diverse founders could enhance impact. PPPs with corporate accelerators and expanded TBIs for deep-tech can address gaps. Global models like Singapore’s tax incentives could inspire India, leveraging the 2025 FoF to lead innovation. A unified startup portal integrating funding, mentorship, and compliance could further streamline growth. Strengthening IP support and fast-tracking patent approvals would also boost innovation. Encouraging state-level startup missions to collaborate can ensure more balanced regional development.

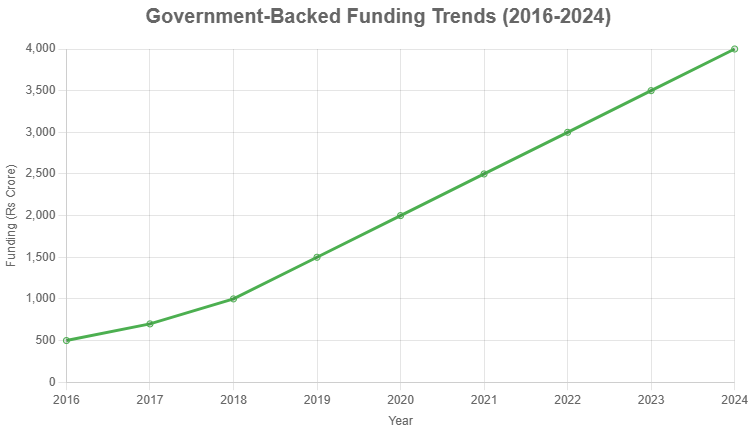

Funding Trends (2016-2024)

Conclusion

Government-backed funds are a transformative force, driving innovation and jobs while promoting inclusivity. However, delays and funding limits highlight areas for improvement. With strategic enhancements, the 2025 FoF can propel India toward a $5 trillion economy by 2027, turning potential into prosperity.

also read: Women Founders in Indian Startups: Growth vs. Gender Gaps

Last Updated on: Monday, July 21, 2025 3:45 pm by Swayam Sharma | Published by: Swayam Sharma on Monday, July 21, 2025 3:45 pm | News Categories: News, Startups, Trending