India’s startup ecosystem, the world’s third-largest with 195,065 DPIIT-recognized ventures and a $450 billion digital economy, is a tale of meteoric rises and sobering resets—112 unicorns valued at $350 billion, yet marred by governance scandals and markdowns that expose a transparency void. From Byju’s 99% valuation plunge to $250 million amid fraud allegations to Paytm’s regulatory crackdown on non-compliance, inflated valuations—driven by exuberant investor hype and opaque metrics—have eroded trust, contributing to a 23% funding dip to $7.7 billion in 9M 2025.

As X users decry “valuations over values,” with only one new unicorn in Q1 2025 and steep markdowns for BigBasket and Unacademy, the opacity—lacking disclosure on costs, margins, and dependencies—fuels credibility crises and deters LPs seeking top-quartile returns. Greater transparency—via mandated private disclosures, sustainability metrics like margins and churn, and robust governance—could recalibrate for sustainable “camels” over fleeting unicorns, unlocking $1 trillion GDP by 2030. Drawing from Bain India VC Report 2025, DealStreetAsia, and ecosystem voices, this analysis unpacks the why and how. Obfuscate, and obfuscate your future.

Table of Contents

The Opacity Epidemic: Inflated Hype Meets Harsh Reality

India’s startup valuations ballooned from 2015-2022, with unicorns surging to 112, but the 2023 winter ($9.87 billion, down 68%) and 2025’s slowdown (one new unicorn in Q1) revealed the fragility of unchecked exuberance. Governance lapses—like Byju’s alleged misappropriation and Gensol’s metric inflation—stem from “valuations-over-values” mindset, where growth-at-all-costs trumps transparency, per Outlook Business. Weak disclosures and “friendly” directors enable obfuscation, with VCs slow to exit favorably, delaying capital recycling. X: “Inflated valuations = pressure cooker for fraud.” Result: Investor caution, with Bain 2025 noting mega-rounds slowing and SME IPOs under scrutiny for pricing opacity.

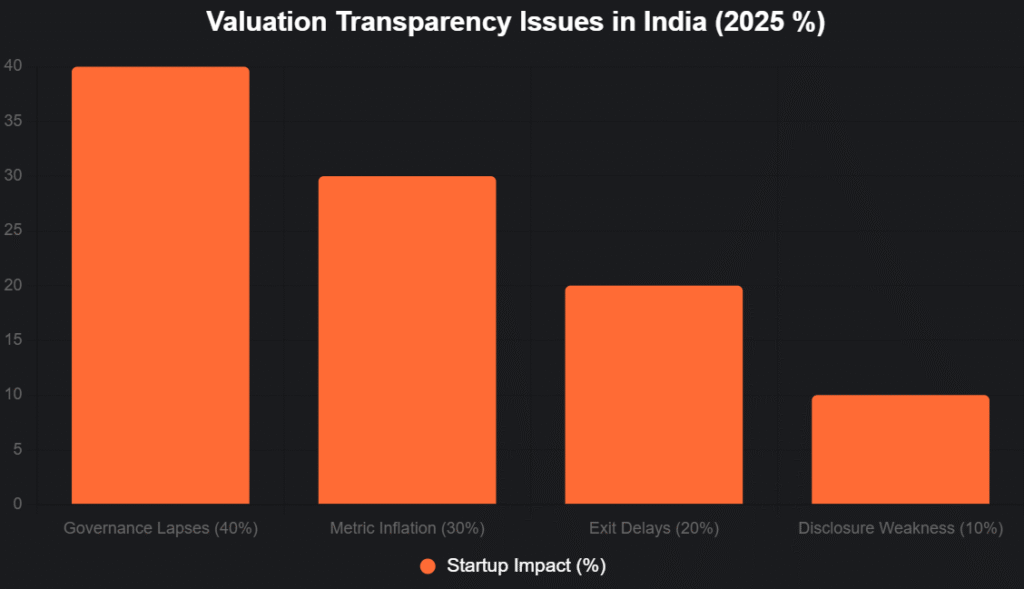

This bar chart highlights valuation issues’ prevalence (2025):

Source: Bain India VC Report, DealStreetAsia. Governance tops, eroding trust.

Why Transparency is Non-Negotiable: The Stakes

Opacity inflates bubbles: Byju’s $22B peak crashed 99% amid fraud claims, while Paytm’s restrictions flagged “persistent non-compliance.” Investors demand “balanced models” with margins, churn, and payback over GMV chases, per SelfEmployed, as LPs seek sustainable returns amid Q1 2025’s unicorn drought. Transparency fosters accountability—SEBI’s SME IPO scrutiny on pricing and promoters signals reform. X: “Transparency isn’t burden—it’s value enhancer.” For India, it could stabilize $15B 2025 funding rebound.

Transparency Gaps Table

| Gap | Issue | Consequence | Fix |

|---|---|---|---|

| Valuation Discipline | Hype-driven entry pricing | Markdowns (e.g., BigBasket) | Mandated sustainability metrics |

| Disclosure Weakness | Opaque costs/dependencies | Credibility crises (Byju’s) | RoC data access for media |

| Governance Lapses | “Friendly” directors | Fraud risks (Gensol) | Stringent frameworks |

| Exit Planning | Delayed capital recycling | Funding winters | Broader due diligence |

Source: Outlook Business, Bain Report.

Case Studies: Opacity’s Cost, Transparency’s Cure

- Byju’s Implosion: $22B peak masked mismanagement; 99% markdown to $250M amid fraud probes—opacity’s ultimate price.

- Paytm’s Peril: Regulatory curbs on “non-compliance” exposed weak disclosures, eroding $16B valuation 70%.

- Zoho’s Quiet Triumph: Zero external funding, transparent margins >60%—sustainable $5B empire sans hype.

X: “Byju’s lesson: Valuations without values = vapor.”

The Transparency Imperative: Reforms for Resilience

Mandate RoC disclosures for pre-IPO startups, broaden due diligence to margins/churn, and enforce “responsible AI” for metrics integrity, per Bain 2025. SEBI’s SME IPO rules on pricing transparency set precedents. Founders: Prioritize “camels” (sustainable scale) over unicorns. X: “India needs camels, not unicorns—transparency first.”

The Clear Horizon: $1 Trillion with Candor

Transparency could stabilize $15B 2025 funding, mint 150 unicorns by 2030. Founders: Disclose boldly. Investors: Demand depth. India’s valuations need candor to endure—embrace it, or evaporate.

social media : Facebook | Linkedin |

Last Updated on: Monday, October 27, 2025 11:30 pm by Business Byte Team | Published by: Business Byte Team on Monday, October 27, 2025 11:30 pm | News Categories: Startups