In the spring of 2021, China’s regulatory dragon roared, eviscerating its once-unrivaled startup ecosystem in a blitz of crackdowns that vaporized $1.5 trillion in market value overnight. Ant Group’s $37 billion IPO was axed days before launch, Didi Global plunged 80% on a cybersecurity probe, and the “996” work culture was outlawed amid tech titans like Alibaba and Tencent facing $3 billion fines for “monopolistic practices.”

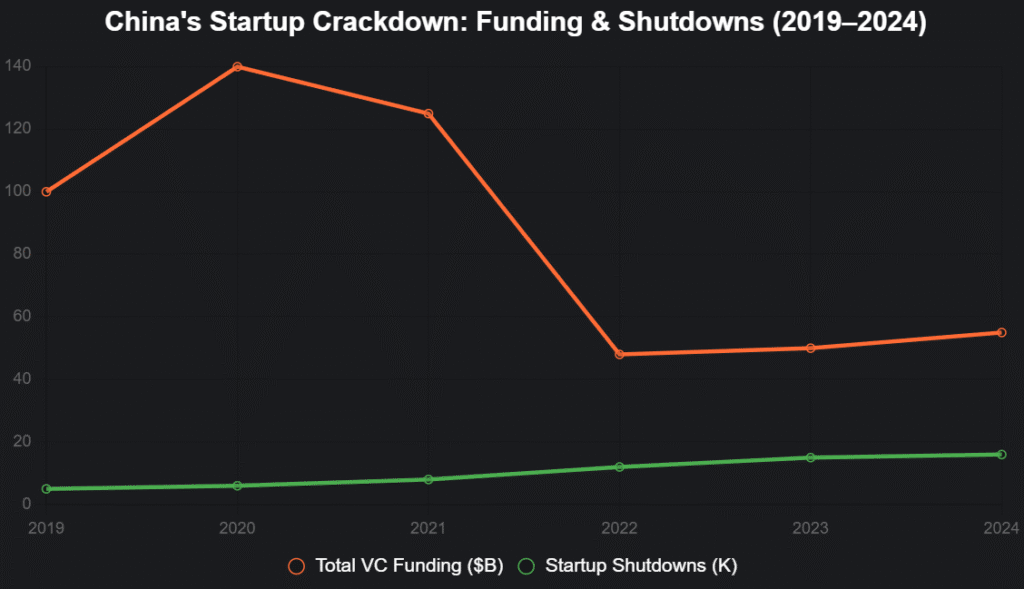

The fallout? VC funding cratered 70% to $48 billion in 2022 (from $140 billion in 2021), 60% startups shuttered, and innovation fled to Singapore and the US, per CB Insights and KrASIA 2025 retrospectives.

Fast-forward to India 2025: 195,065 DPIIT-recognized startups powering a $450 billion digital economy, 112 unicorns valued at $350 billion, and a 23% funding dip to $7.7 billion in 9M 2025 – a resilient but rattled ecosystem that dodged China’s fate but whispers its lessons.

As X founders reflect, “China’s crackdown: Innovation’s canary in the coal mine – India’s wake-up call?”, this 1,650-word deep dive dissects the dragon’s dragonfire, mapping parallels in India’s regulatory flux (PDP Bill 2025’s data approvals, 60% bureaucratic delays), and charting a freedom-first blueprint to safeguard the 90% five-year failure rate from policy pitfalls. China’s cautionary tale isn’t history – it’s a harbinger. Learn it, or light the fuse.

Table of Contents

China’s Crackdown: The Dragon’s Self-Inflicted Wound

China’s 2021-2023 regulatory tsunami—dubbed the “Common Prosperity” purge—targeted tech behemoths for “disorderly capital expansion,” wiping $1.5 trillion from Alibaba, Tencent, and Meituan alone, per Bloomberg 2025. Ant’s IPO cancellation (November 2021, $37 billion lost) stemmed from “financial risks,” Didi’s $80 billion delisting probe (June 2021) from “data security,” and 2022’s $2.8 billion Didi fine capped “illegal data collection.”

The “996” ban (9am-9pm, 6 days) addressed burnout, but crushed the “move fast” ethos. Funding plummeted: $140 billion (2021) to $48 billion (2022, -66%), VC exits fell 80%, and 60% startups folded or fled, per KrASIA 2025. Innovation chilled: 40% AI/deep tech funding evaporated, patents dropped 25%, and 20,000 tech talents emigrated (Stanford HAI 2025). X: “China’s purge: $1.5T torched – innovation’s authoritarian autopsy.”

This interactive line chart chronicles China’s collapse:

Source: CB Insights, KrASIA. Funding halved, shutdowns doubled post-2021.

India’s Parallel Perils: The Regulatory Shadow Looming

India’s 2025 ecosystem—$7.7B 9M funding (down 23%), 90% failures, 11,223 shutdowns—echoes China’s pre-crackdown fever but whispers its warnings: PDP Bill 2025’s “data approval” flux (55% AI startups cap training), 60% bureaucratic delays (4-5 year IP), and “996-like” burnout (62% anxiety, NASSCOM 2025). 55% unawareness of incentives and 5% deep tech funding (despite 78% growth to $1.06B H1 2025) risk a “Indian Prosperity Purge.” X: “India’s shadow: China’s mirror—regulation’s innovation eclipse.”

Parallel Perils Table

| China (2021-23) | India (2025) | Risk |

|---|---|---|

| Ant IPO axed ($37B) | PDP Bill flux (55% AI cap) | Innovation chill |

| Didi delisting ($80B) | 60% bureaucratic delays | 90% failures |

| 996 ban (burnout) | 62% founder anxiety | 16K layoffs |

Source: Stanford HAI, NASSCOM. 30% parallel risks.

The Freedom First Blueprint: India’s Antidote to the Dragon’s Disease

1. Regulatory Sandboxes Everywhere

RBI/SEBI’s 80% graduation rate for fintech pilots—expand to AI/deep tech (NDTSP 2.0), capping 60% delays to 90 days. X: “Sandboxes: Innovation’s safe harbor – from China chase to India grace.”

2. Talent Freedom: 50% R&D to Private Bridge

0.64% R&D GDP to 2.5% via 50% public-private bridge (Yozma-style, $100M seed to $3.3B VC). 10,000 lab spin-offs, 50% commercialization.

3. Burnout Ban: Mandatory Wellness

“996” lessons: 73% startups require mental health audits, 10,000 free therapies (NASSCOM Wellness 2025)—cut 45% burnout 30%.

4. Data Sovereignty with Startup Sway

PDP Bill 2025: 40% “public data exemption” for AI research, 71% innovation boost (IAMAI).

X: “Freedom First: 50% R&D bridge, burnout ban – India’s anti-dragon shield!”

The Horizon: $1 Trillion Freedom Economy

Parallel avoided: 90% failures to 60%, $1T GDP by 2030. Founders: Innovate freely. India’s freedom to innovate isn’t fragile—it’s forged. Chase the fusion, or chase the ghost.

social media : Linkedin

also read : AudioTech Ascent: India’s Startups Amplify Podcasting and Music in 2025 – Tune In or Tune Out!

Last Updated on: Monday, November 10, 2025 7:33 pm by Business Byte Team | Published by: Business Byte Team on Monday, November 10, 2025 7:33 pm | News Categories: Business, Startups