In 2026, the global venture capital environment is more selective, data-driven, and narrative-conscious than at any point in the past decade. While capital continues to flow into innovation, particularly across AI, climate tech, deep-tech manufacturing, fintech infrastructure, and enterprise software, the bar for founders seeking to move from Seed to Series A has risen sharply. At the centre of this transition sits a document that often determines whether a startup progresses to a second meeting or disappears into an investor’s inbox archive: the pitch deck.

No longer a simple slideshow, the modern pitch deck has become a strategic artefact that reflects not just what a company is building, but how it thinks, executes, and plans to scale globally. For founders targeting international venture firms in the US, Europe, the Middle East, and East Asia, the expectations around clarity, coherence, and credibility have become increasingly aligned, even as competition for attention intensifies.

The first and most important shift in 2026 is the primacy of narrative. Global VCs now review hundreds, sometimes thousands, of decks every year, often asynchronously. Decisions about whether to engage are frequently made within the first three to five slides. As a result, successful decks are structured like well-edited stories rather than exhaustive business documents. The opening frames must establish context quickly, presenting a problem that is both real and urgent, followed immediately by a solution that feels inevitable rather than experimental. Investors are no longer persuaded by abstract pain points or generic industry gaps; they want to see evidence that founders understand a specific customer, a specific workflow, and a specific failure in the existing system.

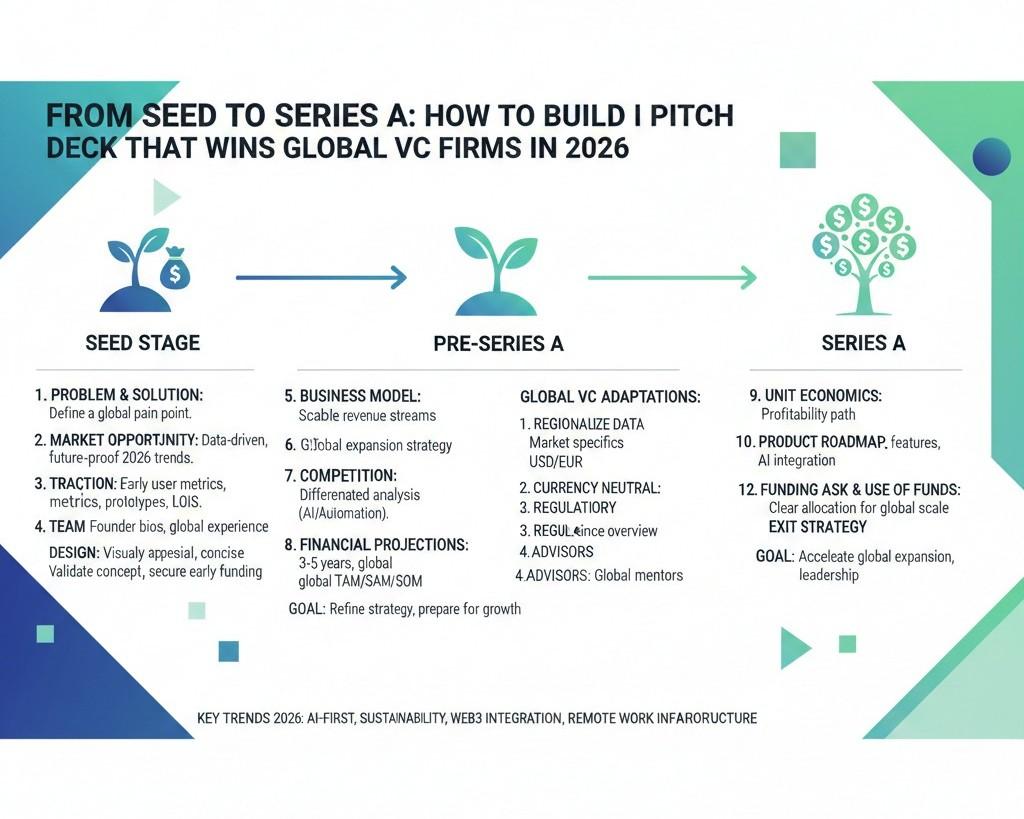

As startups progress from Seed to Series A, the tone of that story evolves. At the seed stage, global investors are still willing to back vision and founder-market fit, particularly in emerging categories. The pitch deck at this stage is expected to answer fundamental questions about why this problem matters now, why this team is uniquely positioned to solve it, and why the opportunity is large enough to justify venture-scale returns. Clarity of thought often outweighs polish. A seed-stage deck that demonstrates intellectual honesty, deep domain insight, and a credible plan to reach initial traction can still outperform one filled with glossy design and inflated projections.

By the time a company is raising a Series A, however, the narrative must be anchored firmly in execution. In 2026, Series A investors are less interested in what a startup plans to build and far more focused on what it has already proven. A winning Series A deck clearly demonstrates product-market fit signals, even if they are still emerging. This includes consistent revenue growth, strong user retention, repeat usage patterns, and early signs of efficient customer acquisition. Metrics are expected to be contextualised rather than showcased in isolation. Growth without explanation raises as many questions as it answers, particularly in an era where investors are wary of unsustainable burn.

Another defining feature of successful pitch decks in 2026 is disciplined market storytelling. Global VC firms have grown sceptical of inflated total addressable market figures that lack grounding in reality. Instead, they are looking for founders who can articulate how they enter a market, dominate a niche, and then expand methodically. The most compelling decks show a clear progression from an initial wedge use case to adjacent opportunities, supported by logical customer behaviour and industry dynamics. This approach signals strategic maturity and reassures investors that growth plans are rooted in execution rather than optimism.

Design, while still secondary to substance, has taken on a more functional role. Investors increasingly consume pitch decks on mobile devices or skim them between meetings. Clean layouts, readable typography, and thoughtful use of visuals are no longer aesthetic preferences but practical necessities. In 2026, the best decks use design to reduce cognitive load, allowing investors to grasp complex ideas quickly. Charts are simple, assumptions are clearly labelled, and each slide is built around a single core message. Excessive text, unnecessary animations, and decorative elements that do not add informational value are seen as signs of poor judgement rather than creativity.

One of the most critical yet understated elements of a pitch deck in 2026 is how it communicates founder mindset. Global VC firms are increasingly attuned to signals around capital efficiency, governance, and long-term thinking. Decks that openly acknowledge risks, competitive pressures, and execution challenges often build more trust than those that present an unrealistically smooth trajectory. Particularly at Series A, investors want to see that founders understand their own constraints and have a credible plan to navigate them. This maturity is often conveyed not through explicit statements, but through the structure of the deck, the consistency of assumptions, and the discipline of projections.

The internationalisation of venture capital has also influenced how pitch decks are evaluated. Founders raising from global firms must assume that investors may not be deeply familiar with local market nuances. As a result, decks that clearly explain regulatory context, customer behaviour, and go-to-market realities without becoming overly explanatory tend to perform better. The goal is not to educate investors exhaustively, but to remove friction and uncertainty from their decision-making process.

Ultimately, the pitch deck that wins over global VC firms in 2026 is one that balances ambition with evidence. It tells a compelling story without overselling, presents data without hiding behind numbers, and demonstrates confidence without arrogance. From Seed to Series A, the deck evolves from a statement of belief into a record of execution, mirroring the startup’s own journey.

In an increasingly competitive funding environment, where attention is scarce and conviction is hard-earned, the pitch deck remains one of the few tools founders fully control. Those who treat it not as a fundraising formality, but as a strategic narrative document, are far more likely to convert early interest into long-term capital partnerships.

Add businessbyte.in as preferred source on google – Click Here

Last Updated on: Monday, February 2, 2026 3:41 pm by Business Byte Team | Published by: Business Byte Team on Monday, February 2, 2026 3:40 pm | News Categories: Business, Trending