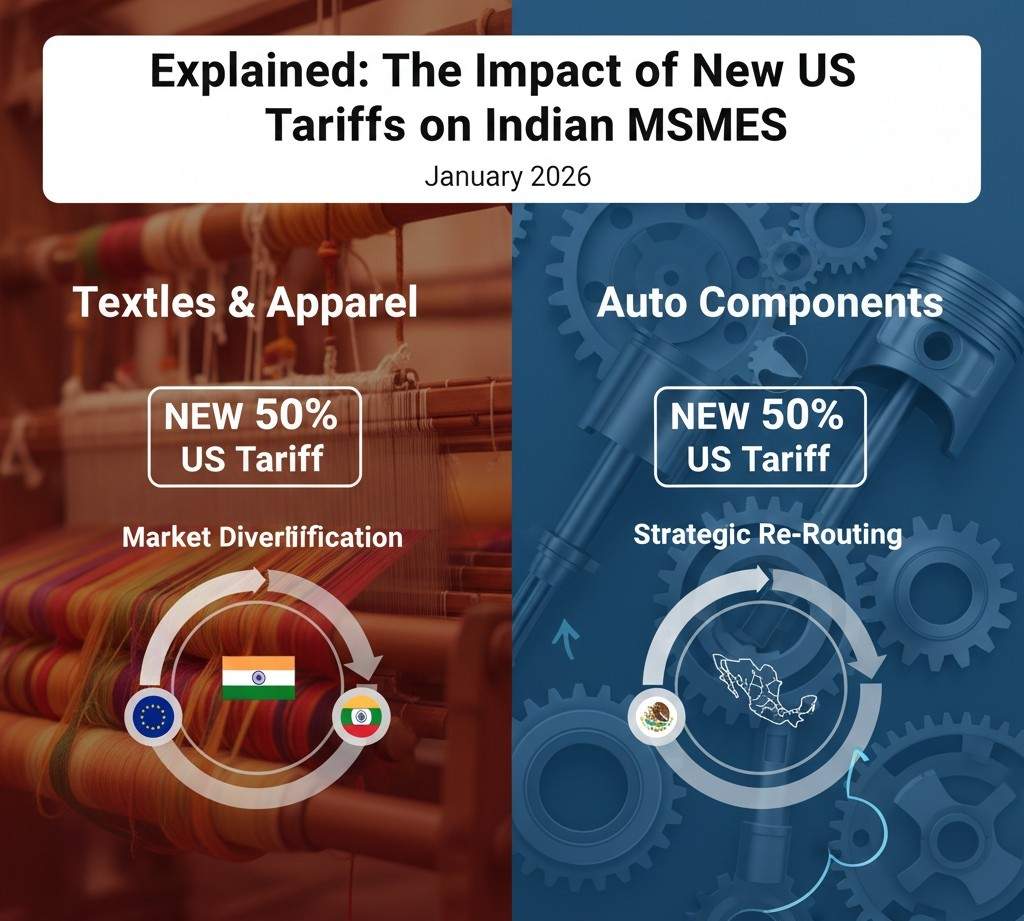

The recent decision by the United States to impose sharply higher tariffs on a range of imports from India has sent ripples through the country’s export ecosystem, with micro, small and medium enterprises (MSMEs) in textiles and auto components emerging as some of the most vulnerable. While the move is part of a broader recalibration of US trade policy, its consequences for India are highly specific, exposing structural weaknesses in export dependence, market concentration and cost competitiveness.

At the heart of the issue is a steep escalation in duties on Indian goods entering the US market. The cumulative tariff burden on several categories has risen to levels that exporters describe as prohibitive, instantly altering price equations that had been painstakingly negotiated over years. For large corporations with diversified markets and deeper balance sheets, the shock is painful but manageable. For MSMEs, which operate on thin margins and limited buffers, it is existential.

The textiles sector illustrates the challenge most starkly. India’s garment and home textile exporters have long relied on the US as one of their largest overseas markets, not just for volume but for relatively stable demand. Thousands of small units clustered in hubs such as Tiruppur, Ludhiana, Panipat and Surat supply everything from basic cotton apparel to specialised made-ups. The new tariffs have made Indian products significantly more expensive overnight, eroding their price advantage against competitors from countries that enjoy lower duties or preferential access.

As a result, exporters report delayed orders, renegotiation of contracts and, in some cases, outright cancellation of shipments. Buyers in the US, under pressure from retailers to keep prices in check amid inflationary concerns, are increasingly shifting sourcing to alternative locations in South and Southeast Asia. For Indian MSMEs, absorbing the tariff hit by cutting prices is rarely an option. Rising input costs, compliance expenses and logistics charges leave little room for manoeuvre, pushing many units into losses.

The impact goes beyond balance sheets. Textiles is one of India’s most labour-intensive industries, employing millions, many of them women and migrant workers. A sustained slowdown in exports risks translating into reduced shifts, layoffs and closures of smaller units. In clusters where export orders drive local economies, the knock-on effects could be severe, affecting everything from ancillary services to household incomes.

The auto components sector faces a different, but equally complex, set of challenges. While finished vehicles form a relatively small part of India’s exports to the US, the country has built a strong niche in components and precision parts that feed into global automotive supply chains. Many MSMEs supply larger Indian firms or multinational companies whose end markets include the US. Higher tariffs disrupt this chain, making Indian parts less attractive and forcing buyers to re-evaluate sourcing strategies.

For MSMEs in auto components, the pressure is often indirect but no less intense. Reduced orders from tier-one suppliers, longer payment cycles and demands to cut costs are already being reported. Unlike textiles, where alternative markets can sometimes be explored more easily, auto components are often designed to specific standards and clients, limiting flexibility. The capital-intensive nature of the sector further constrains the ability of small firms to pivot quickly.

What makes MSMEs particularly exposed is their limited resilience to sudden external shocks. Most lack the financial depth to withstand prolonged periods of reduced cash flow. Access to affordable credit remains uneven, and higher working capital requirements during periods of uncertainty can strain already stretched finances. Compliance with changing trade rules and documentation requirements adds another layer of cost and complexity.

From a policy perspective, the tariff episode has renewed focus on India’s export strategy. There is growing recognition that over-reliance on a single market, however large, carries inherent risks. Diversification of export destinations, accelerated trade negotiations with other regions and deeper integration into alternative value chains are being discussed as medium-term solutions. In the short term, industry bodies have sought targeted relief measures, including easier credit, export incentives and diplomatic engagement to mitigate the immediate fallout.

The situation also raises broader questions about competitiveness. Tariffs amplify existing inefficiencies, from logistics bottlenecks to higher input costs. For Indian MSMEs to remain viable exporters in a more protectionist global environment, productivity gains, technology adoption and movement up the value chain are no longer optional but necessary.

Ultimately, the new US tariffs are more than a trade dispute; they are a stress test for India’s MSME-led export model. Whether this moment becomes a trigger for structural reform or a period of prolonged pain will depend on how quickly firms and policymakers adapt. For now, textiles and auto components stand at a crossroads, caught between shifting global trade winds and the pressing need to reinvent themselves for a more uncertain world.

Add businessbyte.in as preferred source on google – Click Here

Last Updated on: Thursday, January 29, 2026 2:45 pm by Business Byte Team | Published by: Business Byte Team on Thursday, January 29, 2026 2:45 pm | News Categories: Trending