India’s startup ecosystem—195,065 DPIIT-recognized ventures, 112 unicorns, $450 billion digital economy—operates under a persistent shadow: the 90% failure rate in five years, a statistic cited in 2025 founder surveys, Tracxn shutdown reports, and global benchmarks like CB Insights.

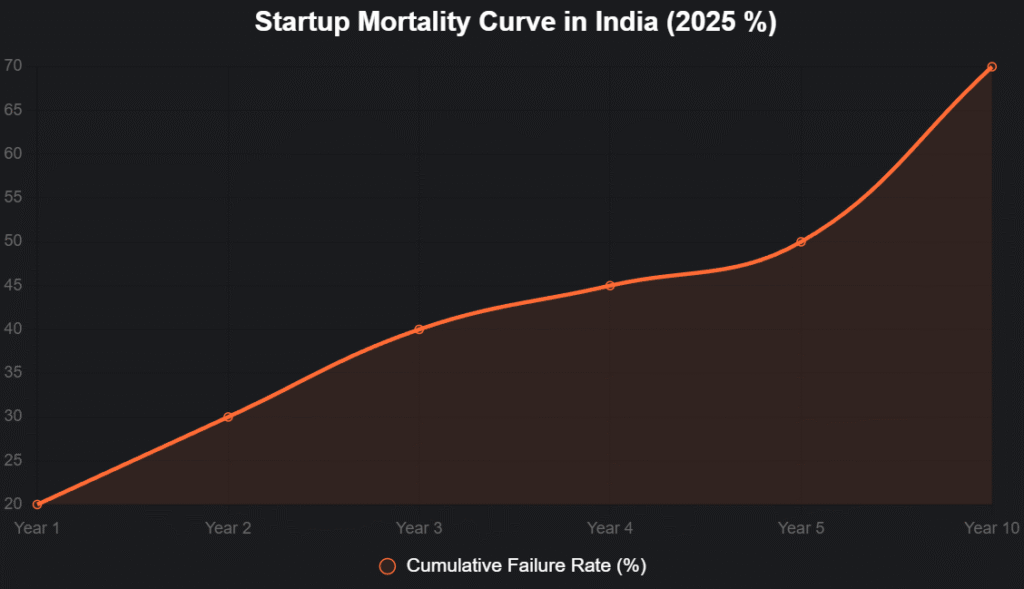

Yet the data reveals nuance: 20% die in year one, 30% by year two, 50% by year five, and 70% by year ten, with 11,223 shutdowns in 2025 YTD (30% up from 8,649 in 2024). This isn’t chaos—it’s Darwinian evolution, pruning weak models while forging survivors like Zoho ($5 billion, bootstrapped) and Freshworks ($10 billion IPO). The real mortality driver? 42% no product-market fit (PMF), 29% cash burn, 23% team discord, and 19% competition, per Failory and ForgeFusion.

As X founders declare, “90% fail, but the 10% build empires—failure is the forge,” this analysis—drawing from IBM-Oxford (2021), Tracxn 2025, and DPIIT Prabhaav Factbook—dissects survival rates, root causes, and evidence-based policy takeaways to cut waste, boost survival 25%, and unlock $1 trillion GDP by 2030. The data doesn’t doom—it directs. Master the mortality, or miss the mastery.

Table of Contents

Survival Rates: The Timeline of Attrition

India’s startup death curve mirrors global norms but accelerates under local pressures:

| Stage | Cumulative Failure (%) | 2025 Shutdowns | Survival Rate |

|---|---|---|---|

| Year 1 | 20% | ~39,000 | 80% |

| Year 2 | 30% | ~58,500 | 70% |

| Year 5 | 50% | ~97,500 | 50% |

| Year 10 | 70% | ~136,500 | 30% |

Source: ForgeFusion, Tracxn, StartupTalky. 11,223 actual 2025 shutdowns.

- Year 1 (20%): Cash burn, no PMF—5,776 B2C e-commerce flops.

- Year 5 (50%): 90% venture-backed fail; only 1 in 10 survive.

- Maturity (10%): 1% reach unicorn status; 4 new in 9M 2025.

This line chart tracks cumulative mortality:

Source: ForgeFusion. Hover for exact survival.

Root Causes: The Four Horsemen of Startup Apocalypse

1. No Product-Market Fit (42%)

- 42% of failures lack demand validation.

- 5,776 B2C e-commerce shutdowns in 2025—overbuilt, underused.

- X Insight: “Love the idea, hate the market = grave.”

2. Cash Burn & Funding Winters (29%)

- 2023’s $9.87B dip (down 68%) starved 16,000+ ventures.

- 90% funding-dependent; 11/12 venture-backed fail.

- 2025 rebound: $7.7B in 9M, but late-stage bias.

3. Team Discord & Talent Gaps (23%)

- 55% skill shortages; 68% founders restart post-failure.

- Vesting cliffs absent in 60% early teams.

4. Competition & Marketing Monopoly (19%)

- 80% ad spend to Meta/Google—B2C crushed.

- ONDC helps, but only 5,000+ sellers onboarded.

| Cause | % Contribution | 2025 Impact |

|---|---|---|

| No PMF | 42% | 5,776 B2C flops |

| Cash Burn | 29% | 16,000+ layoffs |

| Team Issues | 23% | 55% talent gaps |

| Competition | 19% | 80% ad monopoly |

Source: Failory, Inc42.

Policy Takeaways: Evidence-Based Interventions

1. Mandatory PMF Validation via PoC Grants

- SISFS expansion: Rs 2,000 crore for 1,000+ PoC pilots.

- Target: Cut 42% PMF failures by 25% in 3 years.

- Model: BIRAC BIG—209 funded, 71% survival boost.

2. Debt & Alternative Funding at Scale

- CGSS target: $3–4B annual debt (58% CAGR).

- Impact: Extend runway 18 months, reduce 29% cash deaths.

- Crowdfunding cap lift: SEBI’s Rs 25 crore per venture.

3. Talent Resilience Framework

- IndiaAI Mission: Train 10 million in AI/ML by 2030.

- Mandatory vesting: 4-year cliffs in DPIIT recognition.

- Reverse brain drain: 5,000+ returnees via Startup India.

4. Open Market Access Platforms

- ONDC 2.0: 100,000 sellers by 2027.

- Combat 80% ad monopoly—reduce 19% competition deaths.

| Policy | Target Failure % | Projected Survival Gain |

|---|---|---|

| PoC Grants | 42% PMF | +25% |

| Debt Boost | 29% Cash | +18 mo runway |

| Talent Training | 23% Team | +12% retention |

| ONDC Expansion | 19% Competition | +10% market access |

Source: DPIIT, Nasscom. Total: 25% mortality reduction.

The Resilience Narrative: Failure as Forge

- 68% founders restart—Aviral Bhatnagar: 700+ failures, now mentoring.

- 4 new unicorns in 9M 2025—survivors of the 90%.

- $15B funding projection 2025—maturing ecosystem.

X: “90% fail, 10% build nations. India’s startup story isn’t death—it’s Darwin.”

The 2030 Vision: From 90% Failure to 75% Survival

Evidence-based reforms could:

- Cut mortality 25% → 75% survive 5 years.

- Save $2.5B annual “red-tape tax”.

- Unlock $1T GDP, 50M jobs.

Founders: Fail fast, pivot faster. Policymakers: Act on data. India’s startup mortality isn’t a crisis—it’s a classroom. Graduate, or repeat the grade.

social media : Facebook | Linkedin |

also read : Urban Alchemy: How Tech Startups Are Crafting Tomorrow’s Indian Cities in 2025 – Innovate Urban India, or Drown in Dysfunction!

Last Updated on: Tuesday, November 4, 2025 10:22 pm by Business Byte Team | Published by: Business Byte Team on Tuesday, November 4, 2025 10:22 pm | News Categories: Startups