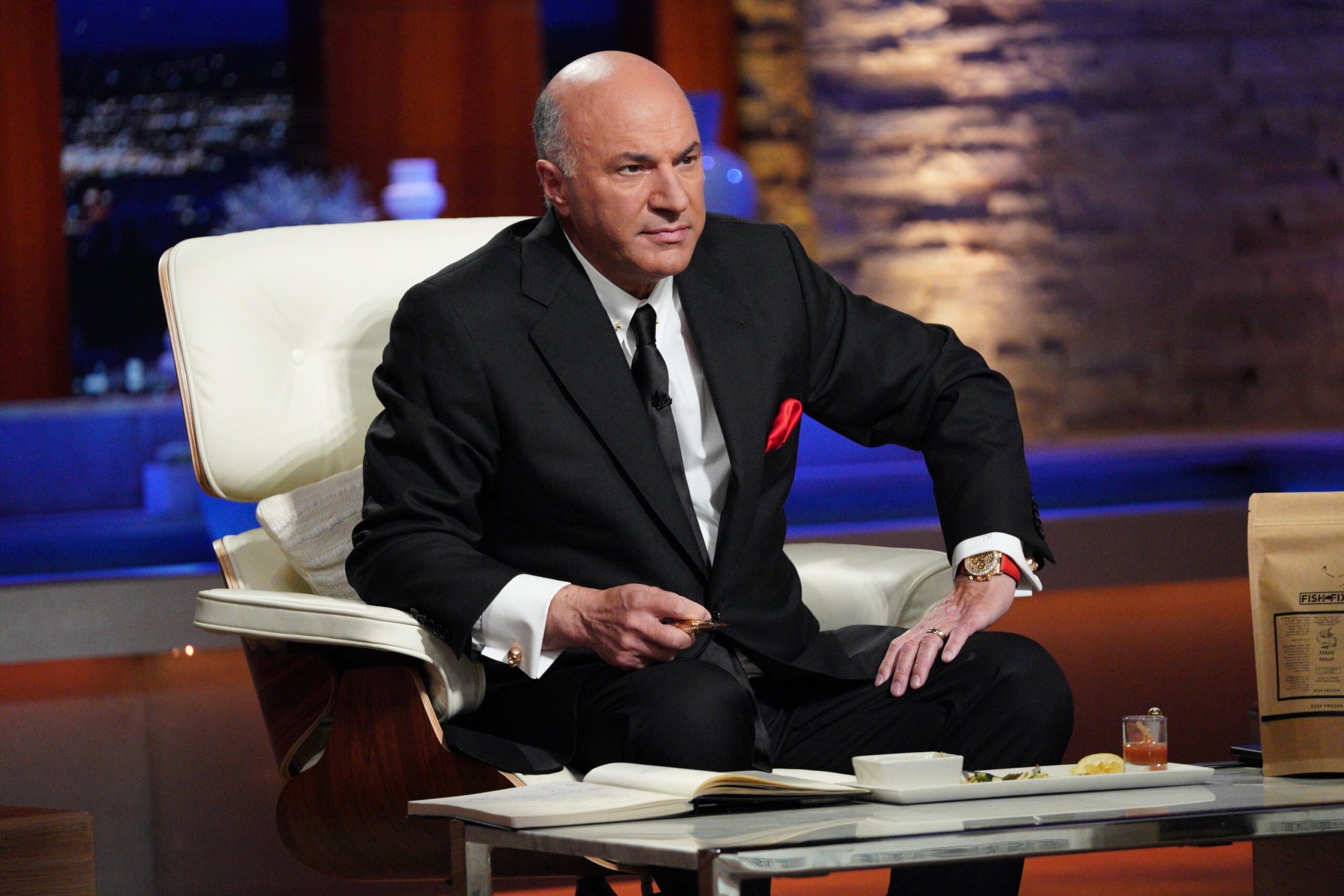

Kevin O’Leary Cautions on Michael Burry’s S&P 500 Bet, Citing Diversification and Downside Risks

Renowned “Shark Tank” personality Kevin O’Leary has offered a cautionary perspective on Michael Burry’s recent bet against the S&P 500, suggesting that the wager could potentially lead to painful consequences. O’Leary’s rationale is rooted in the diversified nature of the index and the inherent risk of limitless downside when shorting individual stocks.

Burry, a well-known investor who gained prominence for accurately predicting and profiting from the subprime mortgage crisis in 2008, has taken a bold stance by betting against the S&P 500. However, O’Leary’s skepticism stems from the fact that the S&P 500 is composed of a wide range of stocks spanning various sectors and industries. This diversification makes it inherently resilient to individual stock downturns, as the broader performance of the index can be influenced by a multitude of factors.

Shark Tank Star Warns of Potential Painful Outcome for the Investor

Shorting stocks, a strategy that Burry is employing in his bet against the S&P 500, carries significant risk due to its potential for unlimited losses. If the value of a shorted stock rises unexpectedly, the losses can mount without a predefined limit. O’Leary’s perspective underscores the challenge of accurately timing market moves and the potential for unforeseen events to impact investment outcomes.

Burry’s notable success in the past, particularly his substantial profit from predicting the subprime mortgage crisis, has earned him respect within the investment community. However, O’Leary’s commentary serves as a reminder that even experienced investors are not immune to risks and that the dynamic nature of financial markets can lead to outcomes that deviate from predictions.

As the financial landscape evolves, the debate over investment strategies and market predictions continues. O’Leary’s cautionary words and Burry’s bold move against the S&P 500 contribute to the ongoing discourse about risk, diversification, and the potential rewards and pitfalls of making significant market bets. Time will reveal the ultimate outcome of Burry’s current endeavor and its impact on the broader investment landscape.